Where Do Top 1% Invest Their Money

How To Build Wealth Fast: The 3 Quickest Ways To Build Your Fortune

stockstudioX / iStock.com

GOBankingRates maintains editorial independence. While nosotros may receive compensation from actions taken after clicking on links inside our content, no content has been supplied past any advertiser prior to publication. Nosotros always recommend reviewing the terms and conditions of whatever offer earlier signing up or applying.

About everyone probably wants to become wealthy at some point in their lives. Some people cull to live frugally to relieve more; others accept risks past investing in high-return investments to build wealth.

In this commodity, nosotros are going to explore the best means you tin can quickly build wealth. Keep reading to learn more.

Your Money: seven Fiscal Habits That Improve Your Daily Life

Follow Along: 31 Days of Living Richer

What Is Wealth?

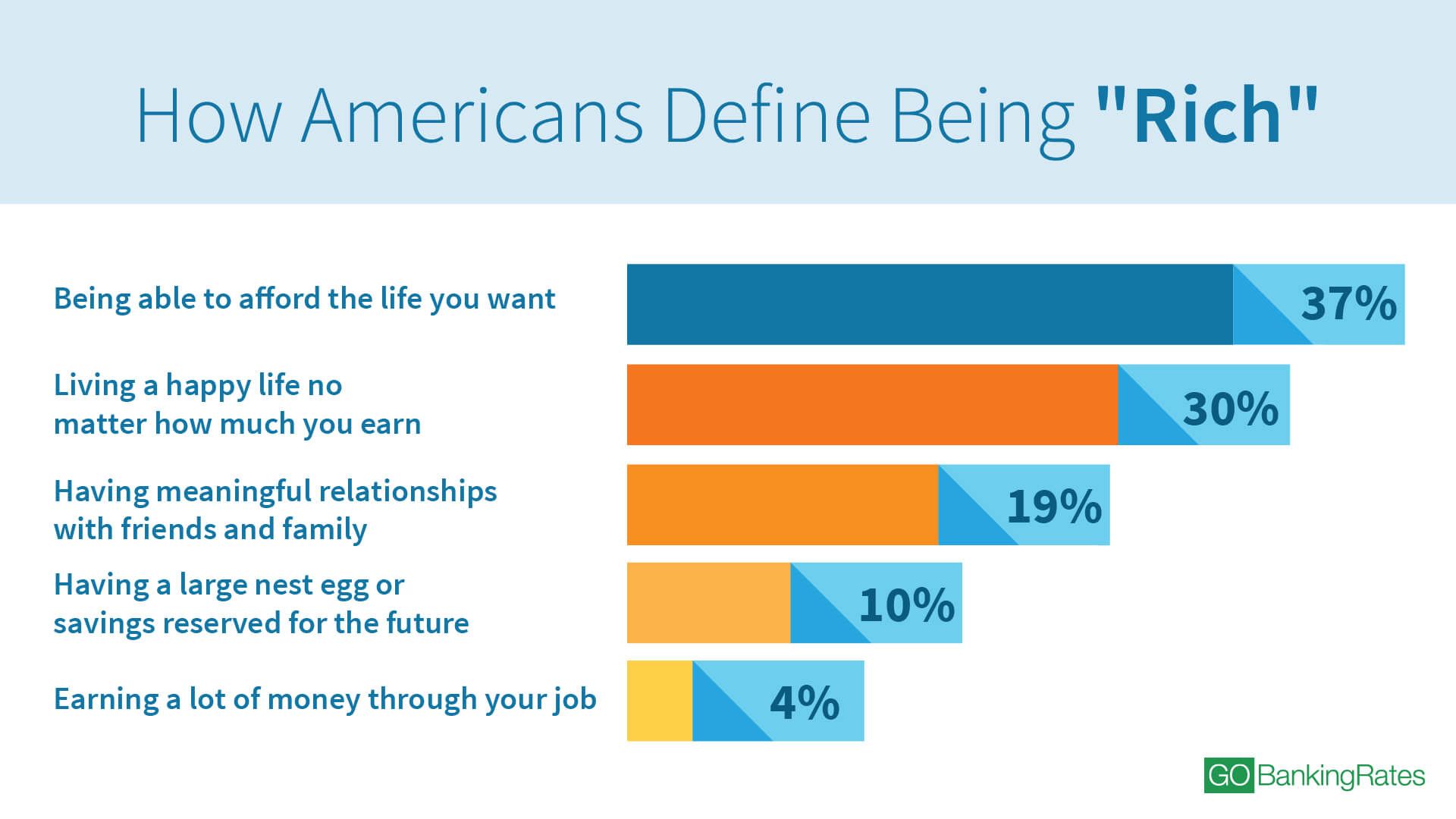

Everyone has a unlike idea of what wealth is. For some, it means owning belongings; for others, information technology means having lucrative investments. From a financial standpoint, the term wealth is the number of assets yous own minus debts.

How To Determine Your Wealth

Add the total market place value of all your tangible and intangible assets, so decrease debts.

Building wealth may seem somewhat impossible, simply it is actually quite simple. In fact, you don't have to earn six figures to turn this dream into a reality. No matter how old you are, yous can amass wealth as long as yous're determined.

Keep in listen that building wealth is not an overnight process.

3 Tips To Grow Wealth

Take a look at these three tips below for ways to build your wealth.

1. Increase Your Income

Whether you're just starting or in transition, having multiple income streams is the near central pace to building wealth. Here are some of the ways you lot can increase your income and build wealth fast.

Venture into Business

The wealthiest people in the world are non employees but business organization founders. Entrepreneurship fulfills two aspects of wealth building: income and high returns on accumulated wealth. Therefore, if you have a business organisation idea that can increment your income, become started.

It doesn't have to be a huge business organization. You can start a small business and offering the services you're adept at. For instance, with the emergence of the cyberspace, you can create an entirely online-based business. If you lot're busy with other things, y'all can hire people to run the business for you lot.

Accept Up High-Paying Jobs

Y'all can check out the U.Southward. Bureau of Labor Statistics for a detailed occupation database. From there, you can see the high-paying jobs and their subcategories that you tin can apply to. More 100 professions pay an average of not less than $80,000 per year. Good examples of professionals paid highly include physicians, managers, nurses and engineers.

However, some of these professions are very expensive. They may likewise accept a lot of time to complete the requisite coursework, and it tin can be even longer earlier you commencement earning a high salary. You should consider all these factors before picking a profession. Whichever career path y'all choose, brand sure it doesn't leave your debt levels too loftier.

Run Side Hustles

Even if you accept a job, you don't have to only rely on your paycheck. Yous tin can run a successful side hustle to increment your income. Yous can plough your talent or hobby into monetary value during your free fourth dimension.

There are many lucrative side hustles you can run online every bit long every bit you accept net access. These include:

- Working as a virtual assistant

- Freelance writing and editing

- Copywriting

- Online tutor, coach, consultant

- Web blueprint, app development, coding, etc.

Other side hustles that don't demand internet access include:

- Function-time professor at a local higher

- Part-fourth dimension gym instructor

- Freelance accounting, tax preparation, tutoring

- Becoming a shopper

- Function-time driver for a ride-sharing or delivery service

Improve Your Skill Set

There are two ways you lot can grow your income and investments in returns. You can either lower your expenses or increase your income. Well-nigh people focus on the first, forgetting the latter. You tin increment your income by honing your skill set. This could include getting a caste, an MBA or a special designation, which can all earn you a promotion and salary increment.

2. Save More

Saving money is another crucial footstep in building wealth. One time you have plenty income to cater to your bones needs, it's time to save. Remember, saving small amounts regularly compounds to substantial wealth over time.

Create a Budget

A upkeep is your fiscal plan, with expenditure estimates versus your income. A budget is an important tool in wealth cosmos. It gives you a view of your expenditure — the things y'all can cut on to increase your savings.

To maintain a viable budget, it is advisable to create a new 1 every calendar month. Tin can yous imagine a sailor without a compass? That'due south what a person who spends their money without a upkeep is like. Such a person will likely eventually suffer a devastating financial crash.

One of the most pop and effective budgeting techniques is the fifty/xxx/20 rule. This method suggests that 50% of your income goes to essentials, like food, rent and healthcare. xxx% allocation goes to not-essentials, such as shopping and luxury activities. The remaining 20% is the nigh important resource allotment, which should go to savings.

Build an Emergency Fund

Emergency fund kits prepare you for unexpected events, similar losing a job. Such occurrences can disorient your wealth-building without emergency funds. 2 common outcomes are selling the investment or incurring debts.

If you incur debts, your wealth starts diminishing. Also, you'll have to pay involvement for the debt. If you sell your investment, yous lose the capital and interests you would otherwise earn. So, to avoid such scenarios, build an emergency fund as your backup money to settle surprise expenditure.

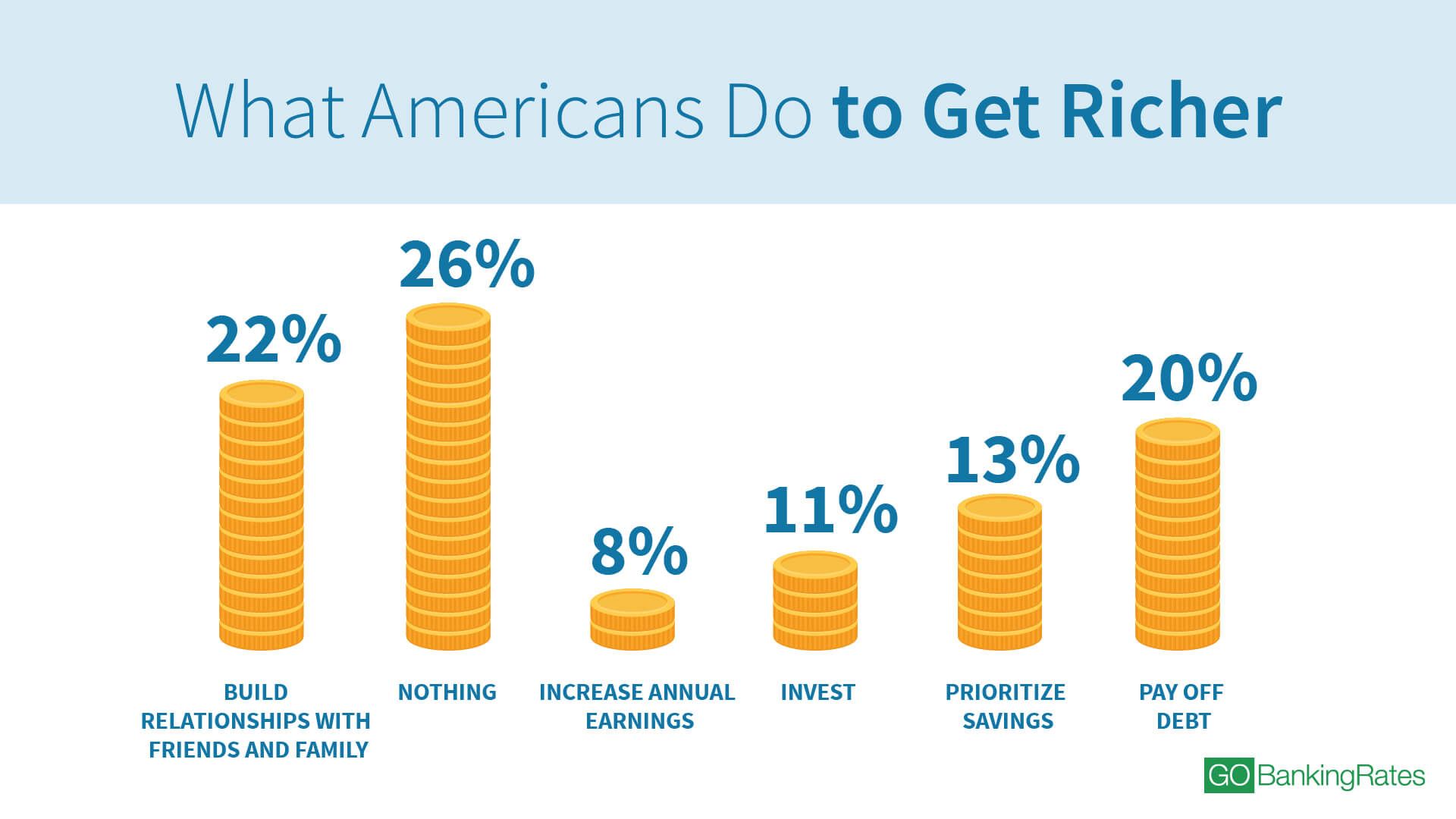

Pay Off Debt

Debt –whether information technology's credit bill of fare debt, mortgage debt, student loan debt or any other kind — can pull you down every fourth dimension you try to build your fortune. You can outset by paying off high-interest debt, so yous can save money and start building wealth.

Live Below Your Means

Overspending can dramatically impact your power to build wealth. Cut spending on unnecessary things like eating out, buying designer clothes and regular vacations. While beingness frugal can be boring and unsatisfying, you'll amass wealth over time and detect it rewarding.

iii. Invest

Once yous've prepare bated a monthly saving goal, it's time to invest. When y'all invest your money, it gives y'all more money in render. Investing your income in the stock market, and in real estate and retirement accounts like a 401(k) or a Roth IRA, can build y'all massive wealth over time.

Stock Market

Buying visitor shares is one of the best and straightforward ways to build wealth. Through shares, you get a shareholder, owning a piece of the company. Buying stocks through exchange-traded funds is a transparent and risk-free grade of investment.

ETFs are passive funds that are less risky. They assistance investors evade high fees and taxes. They also allow you to diversify your equities. That ways you lot tin focus your investment on specific ETFs, like emerging markets, developed markets or American markets.

Even though stocks are much riskier compared to other assets, they accept the best return on investment. With a well-informed diversification strategy, you lot can lower the risks and maximize the returns.

Real Manor

Investing in real estate investment trusts gives you a chance to turn a profit from the real estate industry without direct interest. REITs are substantially real estate visitor stocks involved in buying and selling properties. Mortgage companies besides autumn into this category.

Every fourth dimension the company's value increases, you gain likewise. REITs boast of very high dividends, which y'all can reinvest for more than returns.

401(one thousand)

A 401(k) is a defined contribution retirement account that employers offer their employees. Y'all can dedicate a percentage of your pre-tax salary to this account by signing up for automatic deductions from your paycheck. Your employer tin can also match your contributions.

The investment earnings in a traditional 401(one thousand) grow tax-deferred until withdrawn. If your employer offers it, you should have advantage of it. Though this is non a fast method on its own, you'll be surprised at how quickly your wealth tin increase if you combine it with other strategies.

Roth IRA

A Roth IRA is an individual retirement account that allows for taxation-free withdrawals, equally long as you run into certain conditions. Investing in a Roth IRA is a perfect option if your employer doesn't offering a 401(thousand). The 2021 contribution limit per yr is $half-dozen,000 for people under 50, while those 50 and above can contribute upwards to $seven,000. The best thing most a Roth IRA is that you fund subsequently-tax dollars, dissimilar a traditional IRA, where yous fund pre-taxation dollars.

Last Take

Building wealth is not a rocket science process. With dedication and discipline, you tin can abound your wealth fast. Earlier starting on this journeying, information technology's important to equip yourself with financial education. That lonely should catapult yous through the other steps seamlessly and eventually build wealth.

Many people overlook retirement accounts when information technology comes to edifice wealth. You lot'll not only relieve for retirement but besides grow your wealth over time.

More From GOBankingRates

- 13 Best Places on the West Declension for Couples To Live on Only a Social Security Check

- Nominate Your Favorite Minor Business To Be Featured in GOBankingRates' 2022 Pocket-sized Business organisation Spotlight

- 6 Fastest Ways To Save $20k, According to Experts

- 10 Reasons You Should Claim Social Security Early

Source: https://www.gobankingrates.com/money/wealth/how-to-build-wealth-fast/

Posted by: bittnerwhyall89.blogspot.com

0 Response to "Where Do Top 1% Invest Their Money"

Post a Comment